What makes Banking Marketplace Platform a Boon for Financial Institutions? How can it put Customers at the Centre of the Financial World?

The banking and financial services industry is continuously evolving with different technologies shaping the sector endlessly. Digital Only Banking, Central Bank Digital Currency (CBDC), Regtech with predictive analytics for Risk and Fraud, AI-driven workflows are some of the main fintech trends to watch in 2021.

The banking and payments landscape has evolved to necessitate the need for building an ecosystem for making it more sustainable. Though it doesn’t have much to do with the core banking technologies, it is related to how banks can provide a plethora of products and services for a greater customer convenience, a more integrated experience with increased customer engagement and higher retention. The banking marketplace as a platform can become an invaluable business model.

These days customers are overwhelmed by the convenience-focused services offered by tech companies. The customer expectations have risen manifold with the success of rising super-apps, and they expect to browse a bank’s core services, third-party financial services, fintech services, and other value-adding banking services all in one place.

Financial service providers can grow future-ready and cater to such needs through banking marketplace platform. Many leading banks, incumbent banks, and account aggregator products are rethinking their relevance to customers by responding to the growing trend of banking marketplace ecosystem.

Banking Marketplace Platform

Before we get into details, let us quickly define banking marketplace platform for those of you who are new to this trend. The banking marketplace platform is an aggregation of services and products with similar characteristics that are presented to the customer as a set of competing offers. It enhances the set of products and services that can be consumed by the customers, leading to higher engagement with the Bank, and thereby greater satisfaction, higher retention, and higher Customer Lifetime Value.

Financial institutions and financial service providers can adopt the banking marketplace model. It is a data-intensive, platform-based marketplace where they can compete to offer tailored, value-driven products and services to customers by keeping their needs at the heart of banking.

But, how can Financial Institutions deliver more value to customers through Banking Marketplace Business Model?

The customer demand for service aggregators is expected to grow owing to the ease that follows. Customers are reluctant to visit a place to view a product, another to get insurance, and a third one to secure finance.

Financial institutions working on a banking marketplace business model can enable their customers to leverage a single banking interface to access banking offerings from many financial service providers and financial institutions etc. They can build a direct-to-consumers digital store for trusted fintech, banking, and financial services and products all in one place.

But How?

How can Arttha help you launch a Banking Marketplace Platform

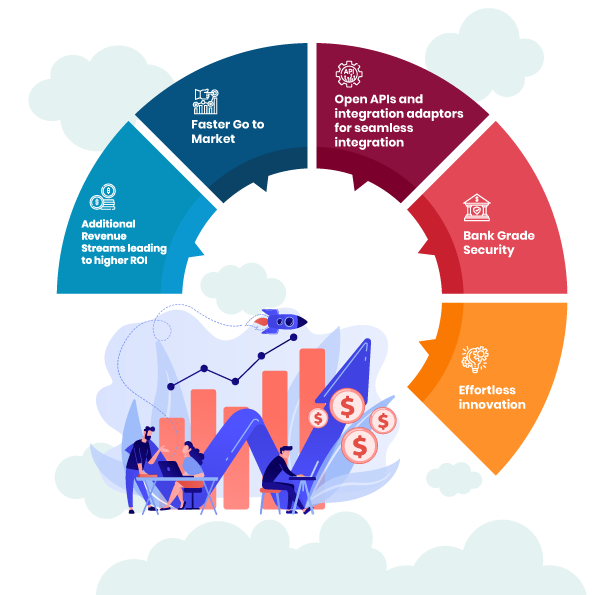

Financial institutions seeking a banking marketplace model or wanting to launch a marketplace can explore opportunities with Arttha, a unified fintech platform. Arttha makes it seamless for financial institutions to join the marketplace.

Arttha accelerates the availability of new services and products and fast-tracks the innovation process for financial institutions like yours through its open banking solutions and APIs. You can pick the services you want to offer to your customers and leverage Arttha to launch your banking marketplace.

Arttha enables financial service providers with an open banking ecosystem that unites the best products right in the hands of the customers. Arttha’s advanced technology and core banking solutions aggregate services and products that a financial institution wants to offer to its customers as a hub of competing offers.

With Arttha, you can offer your customers a place to discover, compare, pick, and select the products of their choice in a trusted and secure ecosystem. Let’s discuss how can we provide you instant outreach. Get in touch.

March 23, 2021

March 23, 2021