Covid 19 pandemic has catalyzed an unparalleled shift in the behavioral patterns of the retail banking customers. During the pandemic, approximately 40% of the global banks either remained closed or operated at reduced working hours. As lockdowns and restrictions were imposed to impede the spread of COVID-19, millions of retail customers found themselves cut off from the essential financial services. Consequently, a swift transition to digital channels was necessary in order to satisfy their growing financial needs. Since 2020, the volume of contactless payments has skyrocketed globally by 50%, and banks’ mobile app usage has surged 42%. Furthermore, Neobank accounts ballooned 20% between 2020-2022.

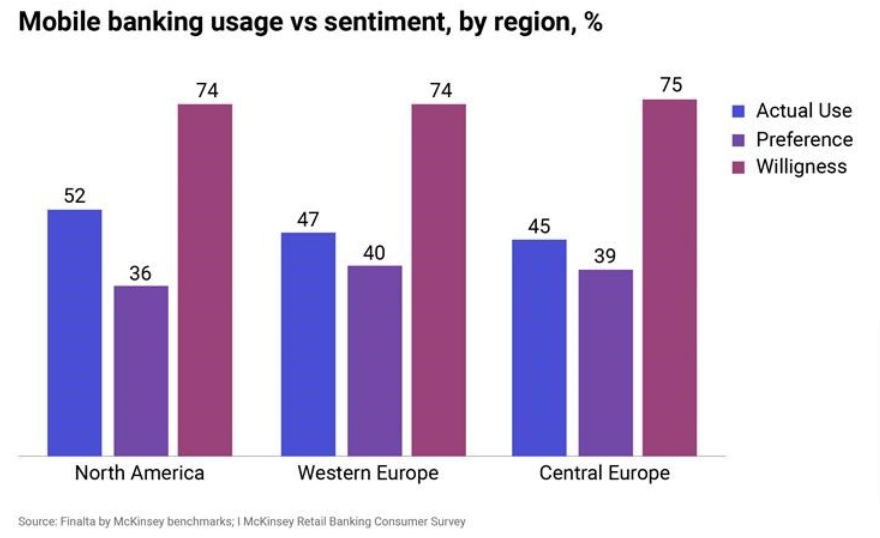

The swift growth of digital banking has sparked the idea that physical channels should be removed and replaced solely by their online counterparts. However, according to a recent Mckinsey article; in excess of 70% of customers across all ages and geographies are keenly interested in using digital retail banking channels; on the contrary, only a select few actually do.

Despite the growing popularity of digital banking, physical bank branches still account for more than 25% of all monthly transactions in much of Asia. Even in more developed markets such as the United States, banks continue to invest heavily in branch presence and services. This is because customers value face-to-face interactions with agents for advice and support on complex financial issues.

In order to keep up with the changing times, banks must find a balance between digital and physical channels. to offer a seamless experience across all digital and physical touch points. This requires integrating both digital and physical processes into an efficient, integrated customer service platform that allows for quick access to financial services. Besides leveraging modern technologies to build digital product suite, banks must invest in modernizing their physical infrastructure such as allowing customers to use ATMs without cards, introducing contactless card payment options, and deploying facial recognition technology for secure access. This will enable banks to provide better service and convenience in the physical space while reducing costs.

Arttha has been enabling global banks and financial institutions to build a future-ready digital retail banking offerings and remodel traditional banking offerings with new-age technologies, thus retaining their presence. Ultimately, banks must give customers the flexibility and convenience to choose amongst all available options. By providing access to both physical and digital channels in an efficient manner, banks can ensure customer satisfaction and loyalty. In this new retail banking paradigm, banks must realize that physical and digital channels not only can co-exist but also complement each other.

January 23, 2023

January 23, 2023