The new normal financial services 2020 and beyond

Author: Manish Sharma, Chief Executive Officer, PureSoftware.

The impact of the Covid-19 pandemic is being felt by countries and businesses all around the world and has already delivered the fastest, deepest economic shock in history. Countries are seeing massive unemployment spikes and numerous businesses are faced with dramatic loss of revenue and struggling to maintain their operations. The major challenge for the entire global economy is to sustain Business Continuity amidst these lockdown and social distancing challenges.

The coronavirus pandemic has forced companies to rethink the way they work, tighten up business travel policies, undertake cost optimization on priority and relook at growth strategies. The online channel which was once a “good to have” one for the brick and-mortar companies has become one of the mandatory channels for the present and foreseeable future. Some companies have already started thinking about leveraging ‘Work from home’ permanently as part of their company policy. Online collaboration Apps like Zoom, Microsoft Teams have seen soaring downloads and an exponential increase in the customer base.

We are seeing this lifestyle change play out in real-time as the contagion accelerates globally; and technology has become indispensable when it comes to accepting and adapting to this new normal.

Covid -19 will change the Way People Bank Forever!

Recent data show that we have vaulted five years forward in consumer and business digital adoption in a matter of around eight weeks.

![]() Banks have transitioned to remote sales and service teams and launched digital outreach to customers to make flexible payment arrangements for loans and mortgages”

Banks have transitioned to remote sales and service teams and launched digital outreach to customers to make flexible payment arrangements for loans and mortgages”

Source McKinsey Digital:- https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/the-covid-19-recovery-will-be-digital-a-plan-for-the-first-90-days

![]() Financial Institutions will need to look towards fintechs, in order to make this shift to digital or even “PHYGITAL” (hybrid of physical and digital) with lower costs and quicker turnarounds.

Financial Institutions will need to look towards fintechs, in order to make this shift to digital or even “PHYGITAL” (hybrid of physical and digital) with lower costs and quicker turnarounds.

![]() DBS Bank has seen 100Mn more digital banking transactions this year, compared to the same period in 2019. The use of digital payments has also more than doubled, with e-commerce transactions rising by as much as close tot 40 percent in value

DBS Bank has seen 100Mn more digital banking transactions this year, compared to the same period in 2019. The use of digital payments has also more than doubled, with e-commerce transactions rising by as much as close tot 40 percent in value

![]() India, where the government has been urging people to use digital payments in the wake of the pandemic, has witnessed a 10% growth in digital payments. In Singapore local banks say the number of customers who have switched to digital banking has grown tremendously

India, where the government has been urging people to use digital payments in the wake of the pandemic, has witnessed a 10% growth in digital payments. In Singapore local banks say the number of customers who have switched to digital banking has grown tremendously

The current situation has acted like a wake-up call for both governments and organisations especially financial institutions. Till recently, for Banks, talking about digital was merely a way of showing customers that they were keeping up with the changing times. But in most cases, this referred to only a superficial digital layer that was customer facing. COVID-19 has disrupted banks’ traditional channels like nothing we have seen before, forcing branch closures, restructuring call centers to work remotely and testing digital delivery channels. Banks may appear to have the best service outward looking, but if not supported internally by robust technological systems then a situation like this has simply served as a rude shock and most Banks have fallen sorely short of customer expectations.

COVID-19 is just a catalyst that has helped push customers along the technology adoption curve. The important fact however is that once onboarded, users tend to stick with the new habit if it’s more convenient. This shift towards digital products and services, accelerated by the virus, will therefore have a long-lasting effect on the years to come. Digital-only is now the new norm and is here to stay. Even after the epidemic, how consumers relate to their bank and do banking will be forever changed.

Young adults are currently the biggest adopters of digital-banking with 25% of those between the ages of 18 and 24 having an online-only account. The other segments have used online merely to support transactions when going to a branch has not been possible. This is about to change, because faced with fear and situations beyond their control, people are adopting technology at a pace as never witnessed before.

By putting the customer at the core of their business strategy, banks can still find a way to add some stability to their businesses. Financial institutions that lead in customer experience have a higher recommendation rate, a higher share of customer mind space and a greater likelihood that these customers stick to them. It is therefore critical to start any digital transformation journey with the customer at its center and as an endeavor to digitize the ideal customer experience. However more often than not, the banks start with their existing process and existing technology stack, and then try to put the client experience on top of that. This is what has led to superficial digital layers which come crashing down at the first sign of crisis.

Consumers’ growing desire for digital banking services will force many traditional financial institutions to fast-track digital transformation efforts, as a result, many of them will have no choice but to turn to fintechs for assistance in drastically reducing time to market for digital banking solutions to the marketplace. As more customers stay and work from home, online investments will also pick up, and Robo-advisors, online trading, and InsurTech etc will be preferred for wealth management. MFIs and NBFCs which have traditionally been driven by physical methods of cash collection, face to face verification and onboarding of new customers will now have to seek new ways to embrace digital.

With the foray of new technologies and financial tech institutions slicing into the banking pie and more importantly, with the uncertainty of global events, the banking industry needs to quickly adapt and look towards elevating the customer experience and also finding a way to engaging customers remotely. This will lead to rising demand for fintech enablers around AI, IoT, and software solutions. One such platform that can help financial institutions and Banks achieve rapid results and quicker go to market is Arttha from PureSoftware.

ARTTHA can help YOU stay ahead of the Curve.

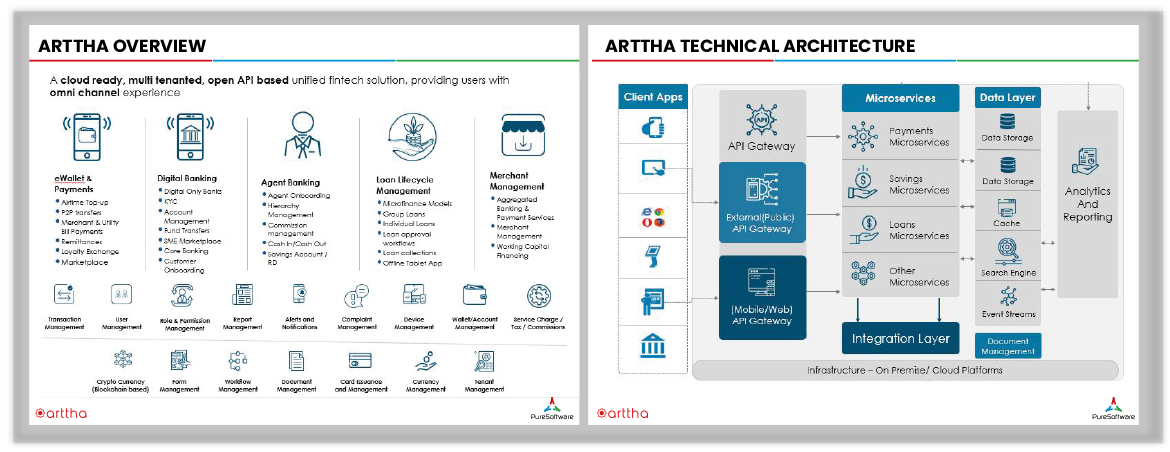

ARTTHA, the unified fintech platform from PureSoftware is a ‘Digital in a Box’ solution that allows financial institutions to leverage the platform in a SaaS as well as on-premise model for enterprise scale deployments. ARTTHA’S lightweight core-banking along with payments help fintechs and legacy banks transform digitally within a minimal lead time and with minimum disruption to their existing systems and processes.

Arttha is built leveraging a microservices architecture with unique microservices for each functional module. Every module can hence run independently of each other and the functionality can be exposed to third party partners leveraging the 300+ APIs in the platform. Click here to know more about Arttha.

Get up and Embrace New

Digital Transformation in no longer a catchphrase, it’s now an absolute necessity for business success

![]() New replaces Old. It is a tale as old as time. The digital age is quickly pushing past the old world and the “Leaders” that are quick to adapt to a mobile first approach for their services will be the first to see improvement in their ROIs and earn some trust from their consumers. Automating processes and improving customer communication by implementing new age digital solutions should be the way forward for banks moving on. The winners will be those who can adapt to customer’s digital behavior with speed and easy of access

New replaces Old. It is a tale as old as time. The digital age is quickly pushing past the old world and the “Leaders” that are quick to adapt to a mobile first approach for their services will be the first to see improvement in their ROIs and earn some trust from their consumers. Automating processes and improving customer communication by implementing new age digital solutions should be the way forward for banks moving on. The winners will be those who can adapt to customer’s digital behavior with speed and easy of access

MANISH SHARMA

MANISH SHARMA

Chief Executive Officer

PureSoftware

Manish is an accomplished leader in the Information Technology Industry with more than two decades of experience across the globe, especially emerging and frontier markets. He Co-Founded the APJ business at PureSoftware and is leading a passionate team focused on Digital Platforms in Clinical Trials, fintech, IoT and IT Services. Based in Singapore, Manish is also an Advisor to multiple technology start-ups and is passionate about fintech, insure-Tech and Digital Platforms.